Signature Programs

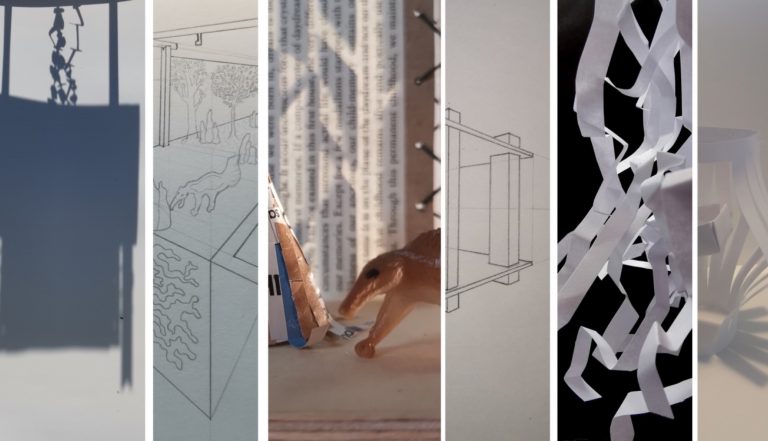

STUDIO FIRST

Sign-up for Studio First Program Updates

Post-Baccalaureate Bridge Program in Architecture

STUDIO FIRST is a full-time, five-week summer studio for individuals from a wide range of academic backgrounds, who are considering graduate studies in architecture, urban design, or landscape architecture. No previous design experience is necessary.

The program provides a post-baccalaureate bridge from an undergraduate degree in any field toward a three-year professional degree program in architecture. Participants gain foundational skills and knowledge and generate portfolio material appropriate for application to a Master of Architecture or related degree program.

Architecture is well-suited to people from diverse disciplines, from visual arts and engineering to geography and the humanities. STUDIO FIRST immerses students in the discipline of architectural design and studio culture and helps them determine whether architecture is the right path to follow.

Imagine Architecture

Sign-up for Imagine Architecture Program Updates

Summer Program for High School Students

Imagine Architecture is a career exploratory studio for grade 10-12 students who are interested in design and who would like to gain experience in creative design thinking and making. Taught by instructors from Carleton’s Architecture program, these fun and intensive workshops will introduce students to the creative culture of design studio, which is at the core of the Architectural Studies curriculum.

Looking for an expedient way to earn ConEd hours?

Azrieli Continuing Education (ACE) courses are professional development courses open to anyone who wants to gain knowledge on specialized topics in architecture. Each course is taught by a multidisciplinary team of subject-area experts in a small classroom setting at Carleton University.

Architects, licensed technologists, and planners who participate in ACE will earn hours to fulfill their continuing education requirements.

There are currently no courses on offer.

Further Inquiries:

For questions about Azrieli Continuing Education Programs, join our mailing list or send an email to Maria Cook

Sprott School of Business – Azrieli School of Architecture & Urbanism

September 26, 2023 to December 7, 2023

Acquire an in-depth understanding of the business side of real estate development.

The Certificate in Real Estate Development (CRED) brings together a range of professionals involved in city building including architects, planners, developers, and investors. Students will acquire the know-how, language, and contacts required to smoothly navigate the complex network of parties involved in real estate development.

Delivery Method: In-person in Ottawa and Toronto and Zoom

Click here to learn more

Who should take this certificate program?

• Developers who are looking to deepen their understanding of development processes, manage risk, and improve their grasp of roles and responsibilities of the various players involved with land development.

• Architects and other design professionals wishing to work more effectively with developer clients and/or to expand their expertise to include real estate development.

• Planners who engage with public/private development negotiations, and who are part of the decision-making on how new development proposals affect their city.

• Property owners who are looking to gain a better understanding of the benefits and risks of development and redevelopment.

• Investors interested real estate as a new category of asset and wishing to engage third-party developers.

• Professionals in service to the development industry, including legal counsel, accountants, and bankers who want to broaden their understanding of their clients’ needs.

• Portfolio managers, real estate advisors, and project managers in the government who wish to better understand the real estate environment in which they work.

What makes this program unique?

• Partnership between Carleton University’s business and architecture professional schools; financial acumen coupled with design thinking and creativity.

• Draws extensively on respected subject matter experts and experienced professionals from Ottawa and elsewhere.

• Networking and mentorship opportunities built into the learning process – from instructors, guest lecturers and fellow students.

• Small class (no more than 20 people). Opportunities for interaction and discussion. Opportunities to learn from each other.

• Conveniently scheduled. Packaged into compact modules of 3-days each.

• Integrated case study based on a recent Ottawa development.

Top 5 Reasons to Register:

• Access to leading real estate and design experts and speakers from across Canada.

• Unique program exploring the complex interdependent relationships of all parties involved in the lifecycle of real estate development.

• Convenient class modules in a part-time format.

• Receive your professional development hours.

• Exceptional networking and sharing of experiences to reinforce learning.

• Designed to advance career growth opportunities.

→ Register

Course Information

September 26, 2023 to December 7, 2023

Course Hours: 8:30 a.m. – 5:00 p.m.

For a full list of individual module dates click here.

Delivery Method:

In person in Ottawa and Toronto and Zoom

Attendance is mandatory

Course Content Management via Moodle

Cost:

Full Program Fee: $8,650 + HST