By Dan Rubinstein

Tourism is the biggest industry in the Bahamas, employing about two-thirds of the Caribbean nation’s workforce directly and indirectly and providing more than half of its gross domestic product.

Banking is the second biggest business. The financial services sector, which supports hundreds of commercial banks, offshore banks, insurance companies, trust companies and offshore companies, accounts for 15 to 20 per cent of its gross domestic product (GDP).

Even though the Bahamas has a population of less than 400,000 and is spread out over more than 700 islands, cays and islets of the Lucayan Archipelago, it has the third-highest GDP per capita in the Americas after the United States and Canada.

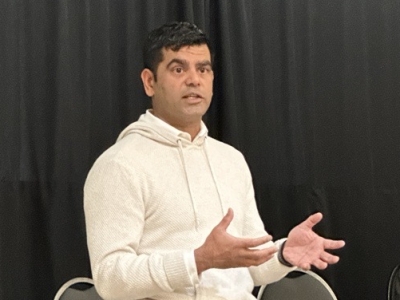

John Rolle

All of this makes the Central Bank of the Bahamas an important international institution, and the governor job a complex and challenging role.

“Because we’re a small country, I have never had the luxury of being narrow in my focus,” says John Rolle, a Carleton University graduate who has served as governor of the Central Bank of the Bahamas since 2016.

“Throughout my career at the central bank, I was allowed to maintain a high-level view of what’s happening, not only in the banking industry but also our economy as a whole.”

Rolle, who spent three years as financial secretary in the country’s Ministry of Finance before becoming governor, and three years on the executive board of the International Monetary Fund about a decade ago, is well suited to help helm the Bahamian economy and navigate its national, regional and global financial relationships and policies.

And he credits his experience at Carleton, where he earned a master’s degree in Economics in 1995, as a valuable stepping stone on his career journey.

Tuesday, June 29, 2021 in Department of Economics, News

Share: Twitter, Facebook