By Karen Kelly

Photos by Bryan Gagnon

The recent election of Jason Kenney and the United Conservative Party in Alberta underscores the dislike some voters have for a carbon tax. Not only has the premier-elect promised to cancel Alberta’s existing tax, he’s pledging to challenge the federal tax in court.

Certain Albertans are not the only ones unhappy with taxes at the gas pump. Drivers in Ontario, Saskatchewan, Manitoba and New Brunswick are also feeling a bit cranky. That’s because the federal government recently imposed a carbon tax on provinces without their own carbon pricing system.

Gas prices jumped overnight, sparking questions such as:

Why should I have to pay for this?

Just where is all of that money going?

How is this going to help with a global problem?

Maya Papineau

Economics Professor Maya Papineau hears these questions a lot, but she says there are some solid economic reasons for making carbon-based fuels more expensive.

“Climate change is a quintessential market failure: it costs our society money,” she explains. “But without a carbon tax or cap-and-trade program in our economies, we don’t consider these costs when we’re at the gas pump or using electricity.”

Pollution is Expensive

Canada’s Changing Climate Report recently found Canada is warming twice as fast as the rest of the world, which increases the threat of extreme weather.

And that extreme weather costs the government—and you and I—money. Whether it’s more frequent flooding, ice storms, or extreme heat, taxpayers foot the bill for infrastructure damage, health care costs and emergency services.

The federal government estimates the total cost to society is about $41 per tonne of carbon dioxide emissions. Papineau says a carbon tax equal to this social cost of CO2 should reduce that pollution, and has successfully accomplished just that in other jurisdictions where carbon taxes have been applied.

“A tax creates a disincentive to buy carbon-intensive products,” she explains. “But it also creates an incentive for innovation. Companies don’t want people to reduce their spending, so they will try to find a way to innovate and find alternatives, such as investing in renewable energy.”

Where is all of this money going?

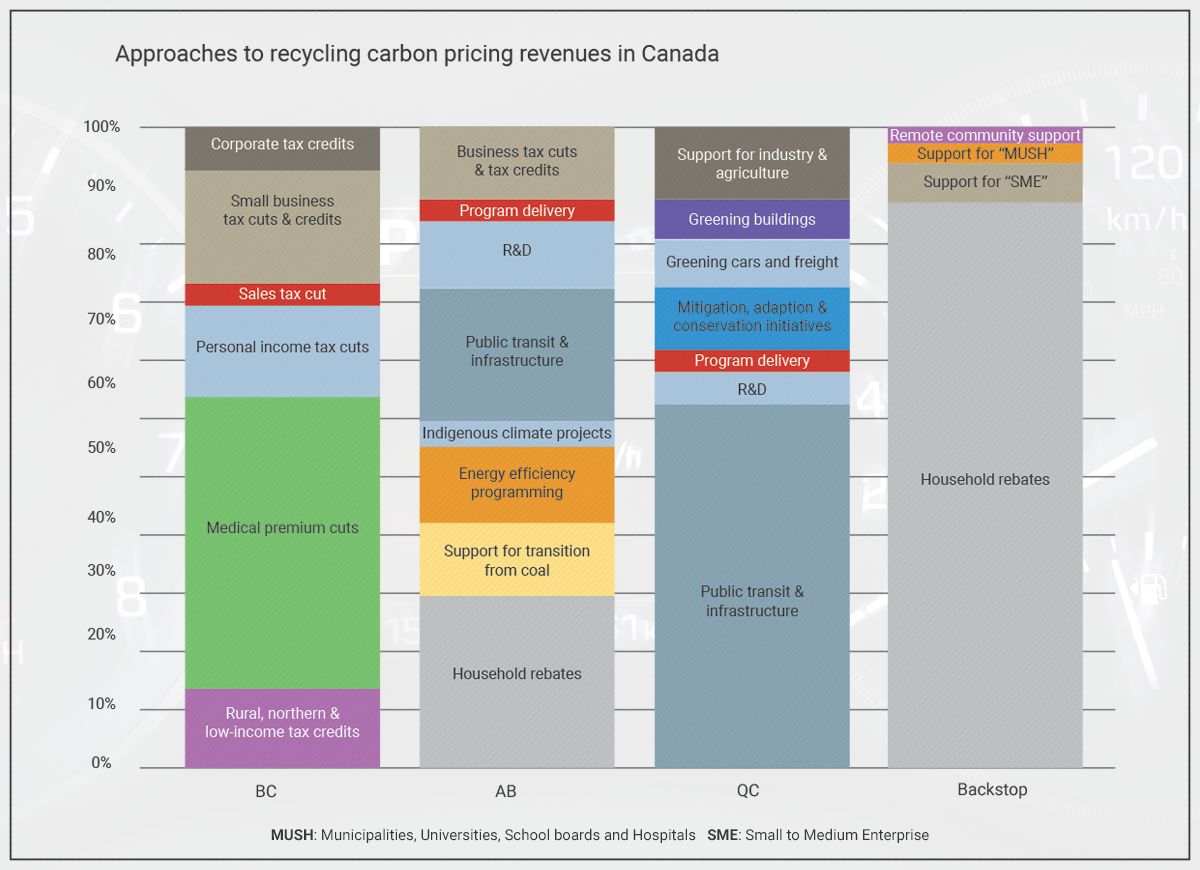

The first three columns represent provinces that adopted their own carbon pricing plan. The backstop column represents provinces that fall under the federal carbon pricing plan. Sources: Government of Quebec, 2013; Government of British Columbia, 2018; Government of Alberta, 2019; Finance Canada, 2019

The federal plan is for 90 percent of the revenue from the carbon tax to go back into our wallets through the Climate Action Incentive rebate. Recipients of the rebate would then be free to spend (or save) it as they wish.

The whole idea is to create a bit of sticker shock to slow down our carbon intensive consumption, but not deliver a large financial hit over the long term.

As an environmental economist, Papineau identifies market failures and suggests policy responses. She’s found the closer people are to their refund, the better.

“For example, during the 2009 provincial election in British Columbia, the NDP ran against the carbon tax imposed by the Liberal government,” says Papineau, who closely followed the race. “At the same time, people had already received Climate Action Dividend cheques in the mail that equaled $100 for every adult and child in the household. The Liberals ended up winning.”

While Papineau doesn’t say the cheques swayed the election, she thinks it’s a smart approach.

A One-time Conservative Policy

These days, conservative politicians around the world are running on platforms that not only oppose any carbon pricing, but sometimes deny climate change altogether. But that wasn’t always the case.

“Some of the earliest champions of the market-based approach were George Bush Sr. and Brian Mulroney,” says Papineau. “One of their tenets was to find the most cost-efficient approach to save taxpayers money. In fact, carbon pricing is the cheapest way to reduce the pollution costs from climate change, so it’s ironic that we have this about-face.”

These days, one of the arguments made by conservative groups is that Canada’s actions will be ineffective unless heavily populated countries such as India, China and the United States take action, as well. Papineau hears this a lot.

“Yes, Canada is a small country, and CO2 damages are a global problem that needs a global solution,” she acknowledges. “But this is exactly what the 2015 Paris climate agreement is trying to solve. Almost 200 countries signed on to the agreement, including China and India, two of the largest global emitters.”

She points out that the developing countries have been given more time to act because they have low income per capita, and typically very low carbon emissions per capita. Papineau says the high income and high per capita carbon emitters— industrialized countries like ours—have to go first.

“If we don’t pledge to take on meaningful reduction targets first, that reduces the likelihood that other poorer countries, who historically have very little responsibility for creating the problem in the first place, will do so.”

Papineau presents another market-based argument for Canada taking action, as well—innovation.

“There is an advantage to being the “first” inventor of clean energy technologies, because that person or group can obtain a patent for it and sell their technology to others,” she explains. “Creating a price on carbon early on incentivizes this innovation in Canada, which has the potential to be lucrative for our country down the line as demand for CO2-reducing technologies rises.”

Much of Papineau’s research has involved improving energy efficiency in commercial buildings and randomized controlled trials in energy conservation. But she is also looking into identifying the benefits of investments in natural infrastructure and urban sustainability, including green roofs and sustainable drainage systems that can lessen the impacts of climate change.

The Cost of Uncertainty

Papineau says financial markets like certainty, and there are a number of external factors threatening Canada’s carbon pricing plans these days. For instance, there are legal cases challenging the carbon tax in Saskatchewan, Ontario and potentially Alberta. Of course there’s always the possibility of a change of government leading to a change in policy.

“Unfortunately, investors will be reticent to invest in innovation if there is a lot of uncertainty,” says Papineau. “To be truly successful, people need to expect the carbon tax to remain and even increase over time, if we want to do our best to maximize well-being in our society.”

Tuesday, April 23, 2019 in Another Take, CSPC2021

Share: Twitter, Facebook