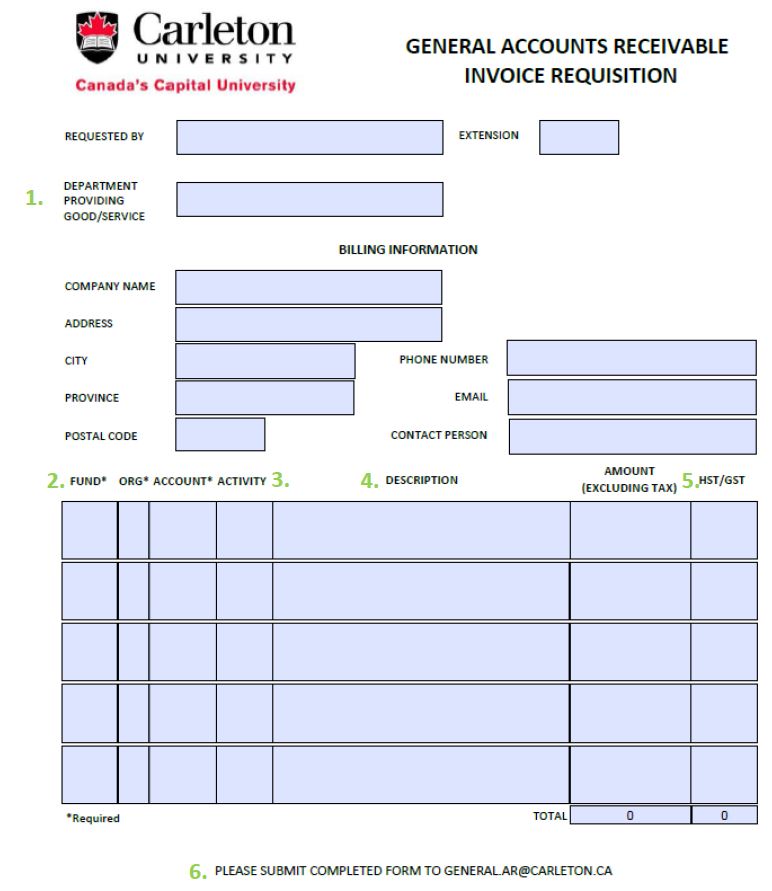

The first tip in this series outlined what General Account Receivable (GAR) does (invoicing!) and how it works. I hope that you find this follow up tip helpful.

Completed forms should be emailed to General.AR@carleton.ca.

A few highlights from the form

- Enter the name of the department that has provided the good or service.

- Fund / Org / Account are mandatory fields that must be filled in. Note that the Account must be a revenue account. Revenue accounts always begin with a 5.

- Activity codes are optional.

- Describe the good or service. This is important because it helps us in GAR determine if the taxes you’ve identified are correct. As an example, your description could be ‘three parking passes for lot 6’ or ‘five thousand letterhead envelopes’.

- Taxes differ depending on the good/service and geographical location. If you are unsure about whether HST/GST applies, review the tax status chart or contact us at General.AR@carleton.ca.

One very important thing to remember …

If the external party sends you a cheque for services rendered, the cheque MUST to be forwarded to 301 Pigiarvik, Receipt Accounting. This is because you have already received payment from GAR.

Where to find out more

If you’d like to find out more, email General.AR@carleton.ca.

Invoicing for some enterprise funds is handled by the Controller’s Office. If you have previously had invoices for your enterprise fund issued through the Controller’s Office or if you were instructed at the time of fund opening, then you should continue to contact your fund administrator for Accounts Receivable inquiries.