Social enterprise is common across the nonprofit sector, and is embedded in how the sector funds activities. At the macro level, earned-revenue activity accounts for 41% of organizations’ revenue sources. In the face of declining revenues from nearly all sources – governments, donors and likely corporations – there’s considerable hope in the ability of organizations to earn revenue from markets for merchandise, food and services of all kinds.

Social finance is an evolving category of financial instruments intended to increase social enterprise. Beyond a simple, repayable loan offered through a bank and available to businesses and individuals, social finance is meant to be easier to access and repay, often with lower interest rates. The investor offers the capital in exchange for a blend of financial and social returns, or for the knowledge that the funds are being used to advance a social purpose. –Bernadette Johnson

However, Imagine Canada’s recent report (Are Charities Ready for Social Finance?) tells us that charities aren’t by and large interested in taking on social finance loans, and their awareness of this revenue source is relatively low, particularly among small and medium-sized organizations. The survey gauges the level of investment readiness of 1,018 participating registered charities, in advance of the release of capital offered through the Government of Canada’s Social Finance Fund. Results show there’s still a lot of work to be done to reach Canada’s charities.

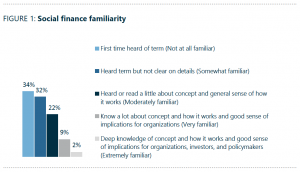

Charities have a low awareness of “social finance,” with 66% of respondents saying either they’d never heard of the term or had heard of it but weren’t clear on the details. From Imagine Canada’s “Are Charities Ready for Social Finance? Investment Readiness in Canada’s Charitable Sector” (Aug. 2020).

The social finance ecosystem – consisting of service providers, investment funds, ecosystem mobilizers and organizations taking advantage of flexible financing instruments – is a pioneering field in Canada. These players, offering advice and connections to the investors, are not well known to the sector. This is curious, as most social enterprises in Canada are either a charity or a nonprofit, and organizations have been engaged in social enterprises for decades. Why wouldn’t flexible, cheap capital offered in exchange for social return be more in demand by those who are, well, good at doing good?

Some speculate that the social finance instruments on offer don’t do enough to meet the unique needs of charities – that, in fact, there’s a lack of flexible, inexpensive capital available to charities. Others say that the barriers to charities are too high because charities are risk averse and accustomed to grants. But according to Imagine’s survey report, many charities carry various forms of debt, so I’m left to wonder at the possible reasons for the lack of interest in social finance tools. Whatever the explanation, Imagine’s survey data, which offers an in-depth look at the many drivers of investment readiness, will advance the conversation.

Due to the COVID pandemic, the social deficit that we predicted would hit the sector (a $30 billion gap between demand for nonprofit services and funds available to pay for them) is here, now, in 2020. This should leave everyone – governments, funders, communities and markets of all sorts – concerned.

Friday, October 2, 2020 in Social Finance

Share: Twitter, Facebook

By

By