Investments

Building the Portfolio

The Asset Mix is the most important investment decision in building an institutional portfolio. The Pension Committee supported by the Pension Fund Management office work with external advisors to complete Asset-Liability studies to determine the appropriate Asset Mix for the risk and return objectives of the Retirement Fund. These studies quantify the projected long-term level of return of different asset mixes relative to the risk as measured by funding ratio volatility and asset risk metrics.

Target Asset Mix

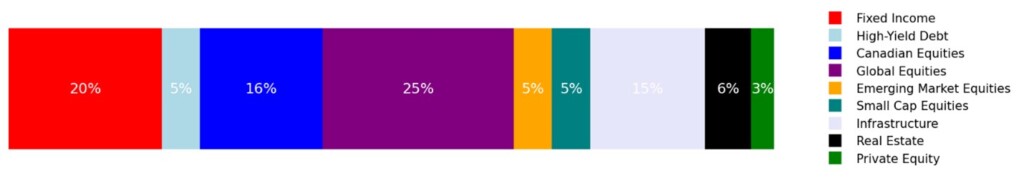

The Statement of Investment Policies & Procedures (“SIP&P”) approved Asset Mix is as follows:

Following Asset Mix approval, portfolio construction is the next step of hiring external investment managers to invest the Retirement Fund’s capital in each of the approved asset classes. For example, within Global Infrastructure there are investment managers that may focus on GDP-linked transportation assets such as toll roads, ports, and airports or investment managers that focus on contracted revenue streams such as hydro, solar, and wind assets.

Costs

The last portfolio decision is managing the costs of the Retirement Fund otherwise known as managing the implementation style. Costs are monitored on an ongoing basis to ensure the Retirement Fund is delivering value-add after fees relative to the Benchmark Portfolio. Each asset class has a benchmark, for example Canadian Equities are measured against the TSX Index. The Benchmark Portfolio is outlined in the SIP&P.

Track Record

The Retirement Fund gross of fees return track record is below:

| As of June 30, 2025 | 1-Yr | 4-Yr | 10-Yr |

|---|---|---|---|

| Retirement Fund | 15.4% | 7.9% | 8.3% |

| Benchmark Portfolio | 13.4% | 7.1% | 7.8% |

| BNY Mellon Universe Median Gross* | 9.7% | 5.5% | 6.6% |

| BNY Mellon Rank | 1st / 70 | 3rd / 70 | 4th / 70 |

*The BNY Mellon Canadian Master Trust Universe results are based on $337 billion worth of investment assets in Canadian pension plans and comprises 70 Canadian corporate, public, university, and several jointly sponsored pension plans such as the University Pension Plan. The Retirement Fund is top decile over all time periods relative to the BNY Mellon Canadian Master Trust Universe.

Investment Case Study

Through our partnership with Westport Capital Partners, the Carleton University Retirement Fund invested in NewCold III, one of the fastest growing advanced automated warehouse and cold chain logistics companies in the world. NewCold’s facilities are the most innovative in the industry, which reduces costs, loading times, and carbon footprints. NewCold is expanding in Canada across Alberta, Ontario, and New Brunswick. Check out their Alberta expansion: