Responsible Investing

Central to our Responsible Investing Policies are the principles of engagement with our investment managers and collaboration with our regulator, peers, and industry associations.

Our partnerships and affiliations include:

Pension Investment Association of Canada

Members of Pension Fund Management’s team are active in the Pension Investment Association of Canada (PIAC), an organization focused on promoting sound investment practices and good governance for the benefit of pension plan sponsors and beneficiaries. We are actively involved in promoting best practices in the Tax Working Group, Ottawa Regional Council, and Asset and Return Benchmarking Committee.

University Network for Investor Engagement

Carleton University is a partner of the University Network for Investor Engagement (UNIE), a network of university pension plans, foundations, and endowments that have a collective shareholder engagement program focused on accelerating the transition to a low-carbon economy in key sectors where advocacy can make the biggest

Canadian Pension & Benefits Institute

Carleton University is a member of the Canadian Pension & Benefits Institute which is a national, not-for-profit organization that specializes in providing its members with industry-related educational sessions across Canada in the pensions, employee benefits and institutional investment sectors.

Association of Canadian Pension Management

Carleton University is a member of ACPM which is the leading advocacy organization for retirement plan sponsors and administrators in Canada who manage plans for millions of plan members nationally.

Principles for Responsible Investment

As signatories to the United Nations-supported Principles for Responsible Investment (PRI), Carleton University and the Carleton University Retirement Plan, commit to six principles for Responsible Investment and incorporate ESG issues into the investment practice.

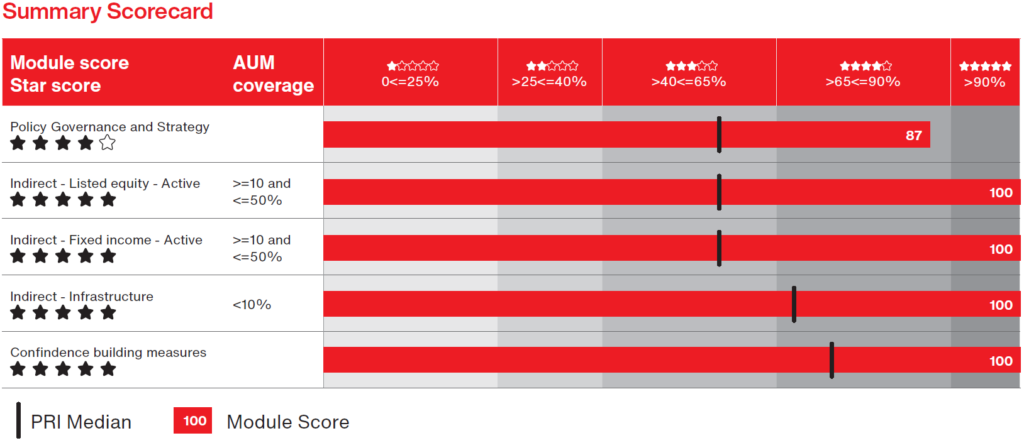

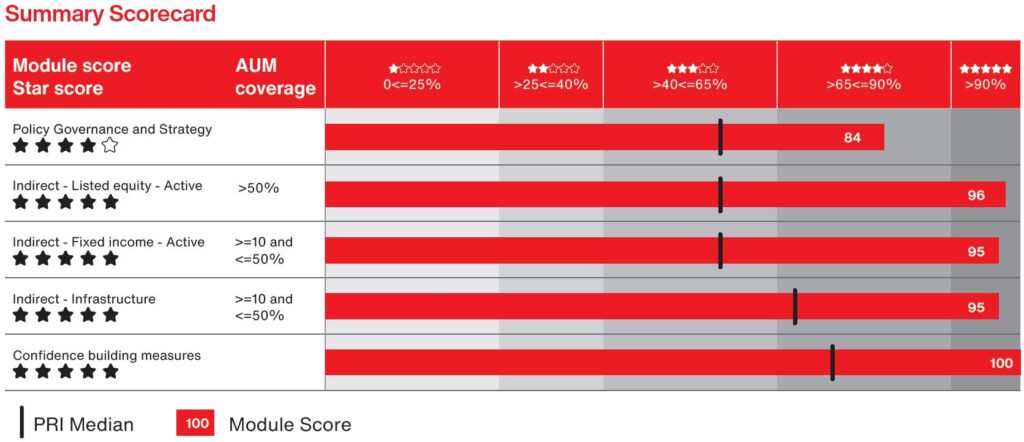

During the calendar year, Carleton University submitted two reports to the PRI; one for the Retirement Plan, and the other for the university’s Operating and Endowment Funds. The reports provided responsible investing activities of the university’s pools of capital. The reports are compulsory and are required of all signatories. The results of PRI’s assessment relative to 5,391 signatories representing over US$121.3 trillion in assets are below.

Carleton University Retirement Plan:

Carleton University Operating and Endowment Funds: