Financial Well-being

Financial well-being is an essential component of a holistic understanding of wellness. Financial well-being refers to your ability to comfortably fulfill all your current financial obligations and needs, while also maintaining the financial strength to sustain this stability in the future. However, financial well-being isn’t just about income. It’s also about having control over your finances, being able to handle financial setbacks, staying on track to meet your financial goals, and—perhaps most importantly—having the financial freedom to make choices that enhance your quality of life. Put simply, your personal finances and your relationship with money has direct impact on your overall well-being.

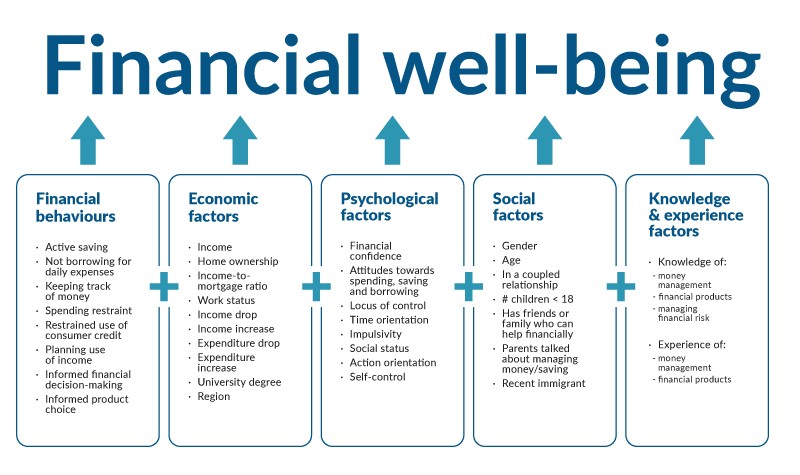

According to the Financial Consumer Agency of Canada (FCAC), there are a number of factors that contribute to an individual’s financial well-being

Financial Well-being Resources

Table of Contents

Canada Life

Building the right savings and investment skills and habits can help you enjoy the here and now while planning for your future.

Canada Life: Saving For Life Webinar Series

Saving for Life webinars will help you unlock the power of your group retirement and savings plan and reach your savings goals. From paying off debt to saving for retirement, they cover a variety of topics to meet you where you are in your savings journey.

Retirement – Saving for your future

Nov. 6, 2024 at 3:00 p.m. ET

Learn about saving for retirement. Whether you’re not sure where to start or want to make sure you’re on track, this webinar is for you.

Retirement – Getting close

Nov. 13, 2024 at 3:00 p.m. ET

Are you thinking about retiring in the next five years? This webinar dives into the details of retirement planning and highlights things to consider when retirement isn’t far away

Your plan – Make the most of it

Nov. 20, 2024 at 6:00 p.m. ET

From managing your savings online to discovering the extra perks included with your group savings plan, this webinar will help you use your plan to reach your financial goals.

Credit Counselling Society

The Credit Counselling Society is an accredited non-profit that helps Canadians solve their money problems. We do this by providing free credit counselling, low-cost debt solutions, and education to help you manage your money better. Our goal is to empower you with the knowledge and tools for building the financial success that everyone deserves. We’re here to help you through your difficult times and towards a better future.

Credit Counselling Webinar: Raising Financially Fit Kids

As parents and guardians of our children, we hold a unique responsibility to teach them how to successfully navigate through life. This can include taking care of their basic needs like, brushing their teeth and getting dressed. But what about money and finances? Learning about how to use money wisely is a life skill that needs to be taught and practiced. If the thought of this is daunting, not to worry! We have the resources to help you get started so your children can understand the benefits of making smart money choices early in order to become financially successful adults.

Employee & Family Assistance Program

Work/Life services are designed to assist you in addressing everyday issues that can interfere with our ability to be focused and effective at home or work. These consultation services are delivered by qualified experts who provide advice, guidance, information, and referrals to community-based resources. These services are delivered via telephone, online, and in-person (where available), and include Financial Coaching and Credit Counselling.

FSEAP Webinar: Managing Personal Finances

This webinar will give participants tools on how to implement and stick to a budget. We will discuss common obstacle to budgeting, and achieving financial goals. We will discuss debt repayment strategies, what to do if they are struggling with debt and how to improve their credit score. At the end of the webinar participants will have a better understanding of how to make their money work for them, what steps they can take to work towards their goals, and where they can turn for trusted advice when facing financial difficulties.

Family Services Ottawa: Financial Empowerment Program

The goal of the Financial Empowerment Program is to support financial independence and empowerment for women, girls, Two Spirit, trans, and non-binary peoples who have experienced gender-based violence. FSO has created educational resources covering a variety of financial topics including RESPs for low income families, financial literacy for new Canadians, the signs of financial abuse, and many more. These resources are translated into multiple languages and available for anyone to use and distribute. This program is funded by the Government of Canada and Women and Gender Equality Canada (WAGE) through the Canadian Women’s Foundation.

Youth Gambling Awareness Program (YGAP)

Promoting Healthy and Informed Choices. The YMCA Youth Gambling Awareness Program (YGAP) is a free service funded by the Government of Ontario offering educational prevention programs to youth and adults involved in young people’s lives on gambling awareness including potential risks, making informed decisions and healthy and active living.

YGAP Workshop Series with Healthy Workplace

Healthy Workplace is thrilled to be partnering with YGAP throughout the month of November to offer two virtual webinars to Carleton University Faculty and Staff.

Gambling, Money and Decision Making

Wednesday, November 13th, 2024 at 12:00 pm to 1:00 pm

Sports Betting: Separating Skill from Illusion of Control

Tuesday, November 26th, 2024 at 12:00 pm to 1:00 pm