The government has announced a tax break on qualifying goods, including some food and beverages and physical books. The complete list of qualifying goods can be found on the Canada Revenue Agency website. If you are purchasing a qualifying good on behalf of Carleton, please ensure the vendor is not charging HST or GST.

eShop Invoices

If you receive an invoice from a vendor for a qualifying good that incorrectly contains HST or GST, contact the vendor for a revised invoice before submitting the invoice to Accounts Payable.

SAP Concur Travel & Expense Reimbursement Claims

If you have incorrectly paid tax on a purchase of a qualifying good, you can submit the expense claim as usual (without adjusting the taxes) as long as you have the receipt to verify that tax was paid.

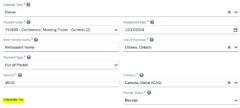

If you are submitting an expense claim for a qualifying good and did not pay HST or GST, you can adjust the taxes to zero when entering the expense.

After you have entered the expense details click “Calculate Tax”.

A field will appear containing the system’s calculation of taxes. Enter “0” as the amount to override the system calculated amount.

Pcard

As usual, when reconciling your pcard, you should ensure the tax recorded matches the tax on the receipt.

The credit card company will estimate the amount of taxes and pre-tax amount (Net) for the transaction based on the location of the merchant. Verify the tax and Net amounts with your receipt, and if there are any discrepancies, update the amounts to match.